Table of Content

- Traditional automakers committed to investing billions in electric vehicles

- Deals for large purchase orders to electrify fleets

- Traditional automakers increasing spending on EV advertising

- Big Tech companies also entering the EV industry

- EV charging infrastructure is rapidly expanding

- Cost of EVs continues dropping

- Consumers are increasingly receptive to purchasing electric vehicles

- Sales of electric vehicles have accelerated over the last few years

The electric vehicle industry, with its prospects and challenges, has been gaining prevalence for several years, but more recently signs of widespread EV adoption have become especially apparent. Is there any doubt that the future is electric? Consumers, companies, and governments are all moving with increasing speed towards electrification. Potential barriers to the adoption of electric vehicles, although still a reality, are being rapidly overcome. 2021 and 2022 brought several notable examples of electrification, including a renewed commitment to global emissions targets, clean energy market growth and commercial vehicle electrification as major electrification trends. Within the span of a few years, much has transpired in the industry and the vision of the electric future is even clearer. Now, what are the particular EV trends that forecast widespread electric vehicle adoption in 2023 and beyond?

1. Traditional automakers committed to investing billions in electric vehicles

Not only have automakers pledged to make a significant percentage of their cars electric over the next decade, but many, such as Ford, Volkswagen and Honda, have already announced sizable investments to accelerate EV production over the coming years. It is estimated that the automotive industry will invest over $500 billion by 2030 for its EV transition. In recent years, the variety of electric car models was extremely limited, and it served as one of many barriers to electric vehicle adoption. But there is no longer a shortage of electrification examples on the part of car manufacturers. Now that traditional automakers are attuned to the business opportunities in electric vehicles, the investments in EV innovation and manufacturing facilities are swelling. In turn, the number of EV options for consumers is quickly rising.

2. Deals for large purchase orders to electrify fleets

Hertz’s order for 100,000 vehicles from Tesla resulted in the company surpassing a $1 trillion market cap in the final quarter of 2021. While the agreements of most automakers with car rental companies are unremarkable, Hertz’s order was a clear signal that electrification was becoming mainstream. Perhaps even more impressive was the investment by Amazon and the announcement of Amazon’s 100,000 EV order from Rivian, which occurred almost two years prior to the Hertz-Tesla deal. Both orders signify a huge move to electric vehicles.

Other notable electrification examples include the large electric fleet orders in GM’s deals with Walmart and FedEx. Given the huge impact that heavy duty electric vehicles have both on cost-savings and on the reduction of emissions, the acceleration of electric truck adoption among other vehicles is a very significant electrification trend. As more and more companies realize the benefits of electrifying their fleets, the strengthening of this electrification trend becomes inevitable.

3. Traditional automakers increasing spending on EV advertising

Automakers are well-aware that without the interest of consumers in electric modes of transportation, they will not be able to successfully transition into the EV market. Other than rare magazine articles on electric cars or the niche publications about electrification, until recently mainstream media was largely devoid of the subject. Prior to 2021, there had been relatively little advertising attention given to electric vehicles. While traditional automakers have a history of heavily advertising, EVs were clearly not their top priorities. In addition, the leading automaker in the EV market, Tesla, is renowned for not advertising at all. Electric vehicles were essentially absent from advertising. But this changed in 2021. Automakers went from $83M and $65M in 2019 and 2020 respectively, to an unprecedented EV advertising spend of $248M in 2021. The start of 2022 seems to follow the same trend, as evident by several Super Bowl ads from major automakers. Interestingly, Tesla’s powerful brand recall in the category of electric vehicles made the company a major beneficiary of these EV Super Bowl ads, despite all the advertising efforts coming from other automakers. Given the Super Bowl’s status as one of the most expensive television advertising slots, and the huge attention given to all Super Bowl commercials, it is no coincidence that the major automakers are shifting gears to go full speed towards EVs, taking the public with them. Of course, there is still much room for EVs to grow in prominence since total advertising budgets for the major car brands total upwards of $3 billion. A continuous shrinking of advertising spend will be inevitable in the future of gasoline cars as automakers shift their focus to the EV revolution.

4. Big Tech companies also entering the EV industry

On the one hand, there are the electric-only automakers, such as the pioneer Tesla and the more recent Rivian. On the other hand, there are the traditional automakers who have more recently recognized the widespread EV revolution gaining momentum and are rapidly investing to enter the market. But there is a third group that is interestingly also venturing into electric vehicles: technology companies.

For years there have been rumors and news of companies such as Apple, Google and Amazon developing or investing in electric cars, particularly with a focus on self-driving systems. Chinese big tech has also been keen to enter into the autonomous EV market, with the likes of Huawei, Baidu and Xiaomi making large investments. The surprising news from consumer electronics company Sony of a prototype EV, announced at CES at the start of 2022, was further evidence that the EV market looks extremely promising and will soon approach widespread adoption. It seems no company wants to be left out, and it appears consumers are also open to the idea. In a recent Canadian survey 49% of respondents expressed willingness to buy an electric car built by a technology company.

5. EV charging infrastructure is rapidly expanding

Governments at all levels are increasingly investing in a variety of charging infrastructure to support widespread EV adoption. In the United States, the Biden Administration revealed a plan to spend almost $5 billion over five years in order to build a large network of electric vehicle charging stations. A hope of this plan is to have a charging station every 50 miles along interstate highways so that drivers can sustain longer trips with their EVs, which could possibly reduce some of the concerns drivers have with adopting electric vehicles.

In addition to EV charging station growth due to government efforts, companies have also made EV infrastructure more widely available to the public. Tesla’s Supercharger network has historically been one of the benefits of owning a car from the company, but a pilot project released in November of 2021 changed that. The project began to allow drivers of other electric vehicles to use the company’s extensive charging network, albeit only in select countries in Europe. Even so, this signals a significant move both for Tesla and for the market at large, especially if the number of countries for whom access to their EV charging stations is available expands soon. A host of other companies, some specializing in EV charging, some oil companies, hotels and stores among others, have also started to invest in electric vehicle charging infrastructure.

Since the lack of charging infrastructure is chief among the barriers to EV adoption, it will be vital that electric charging stations continue to be built at an accelerating rate. Overcoming barriers to deployment of plug-in electric vehicles will necessarily require electric charging stations and infrastructure matching the prevalence of gas stations. At the same time, EV charging behavior will have to be studied closely so that infrastructure needs are tended to adequately. For instance, not every charger may take the form of its gas station counterpart. Public chargers that also serve as electric vehicle parking for those who do not have access to a garage is a need many city dwellers have. Both the prospects and challenges for electric vehicle infrastructure are many, but EV charging station growth over the last year has been a promising trend.

6. Cost of EVs continues dropping

One of the issues with electric vehicles that consumers struggle with is the upfront cost of purchase. Most people expect to purchase an EV for less than $50,000 according to a Canadian survey. Given the high cost of batteries, electric vehicle inverters, motors, and other parts, automakers in general have not yet passed this threshold. However, trends are promising in showing just how close the industry is to this point. Over the years, the cost of battery packs, for instance, which make up a significant percentage of electric vehicle manufacturing cost, has plummeted. A lithium-ion battery pack went from an average cost of $1,200 per kWh in 2010 to $132 per kWh by the end of 2021, an impressive 89% decrease. This cost is very close to the $100 per kWh mark that would make the pricing of electric vehicles competitive with their internal combustion engine counterparts. Interestingly, the price of new vehicles in general rose by an average of 2.2% from 2020 to 2021, in contrast to EVs, which decreased by 10.8% during the same period. This electrification trend clearly hints at the future of ICE cars and their electric counterparts. It is only a matter of time before pricing is overcome as a barrier to EV adoption.

7. Consumers are increasingly receptive to purchasing electric vehicles

A growing number of consumers have accepted that the future is electric. While survey results for EV purchase consideration vary widely, they generally indicate high interest by the public. One survey showed that in the United States, some 60% of consumers would consider purchasing an electric vehicle. A different survey, with more specific and practical considerations in its questions, showed a more conservative but still significant percentage of respondents considering purchasing EVs, namely 23% of Americans. Yet another survey says 48% of Americans would consider buying an EV. Regardless of the exact percentage, these reports seem to indicate that the number exceeds double digits, suggesting a general trend of increasing consideration towards the purchase of electric vehicles.

This electrification trend has consisted of a tremendous shift towards electric vehicles in the mind of the public. Whereas in the past many might have thought “I will never buy an electric car” and that electric cars will fail, now increasingly cultural attitudes revolve around questions such as “what if all cars were electric?”, "why EVs are the future" and popular phrases such as “the EV revolution”. It is important to note, however, that it is not just in theory that consumers are considering buying electric vehicles. The data clearly indicates that sales of electric vehicles are accelerating as evident by the next trend.

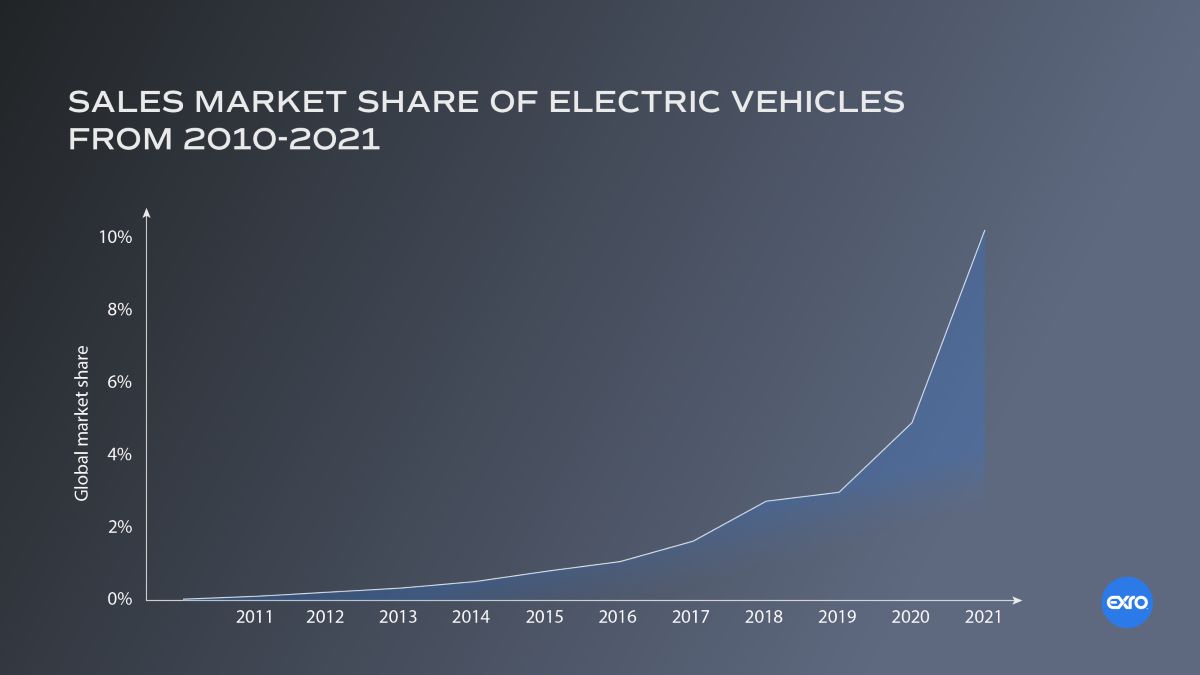

8. Sales of electric vehicles have accelerated over the last few years

What would happen if everyone used electric cars? What does the future hold for electric cars? Pondering such questions will soon be not merely a speculative exercise, but a present reality. According to the International Energy Agency, global market share of electric vehicles grew from a negligible 0.01% in 2010 to 4.11% in 2020, and an astonishing rise to 8.57% in 2021. The electric vehicle adoption curve is impressive. China and Europe see the fastest growth, and the United States is behind them with a more gradual growth. Given the data and reports on consumer attitudes after lockdowns, it is evident that the pandemic had a considerable contribution to this growth. Furthermore, some projections of 2022 EV sales estimate at least a 50% growth in relation to 2021. By most accounts, the markets all seem to be accelerating rapidly toward mass electrification. The view is clear, the fast-approaching world of widespread EV adoption is almost here.

Overcoming EV adoption barriers with a dynamic EV inverter

What defines the speed of vehicle electrification trends? Not only electric vehicle prospects but also challenges. Even considering the above electrification trends, we know the current market share of EVs compared to other vehicles is nowhere near the percentage of consumers receptive to EVs, especially in the United States. In this respect, we know that there are still barriers impeding consumers from taking the step to convert to electric vehicles. Among these EV adoption barriers are charging infrastructure, vehicle performance, and cost.

Electric vehicle performance and cost can be greatly improved by the revolutionary EV inverter that is the Coil Driver™. Exro Technologies is a clean technology company pioneering intelligent control solutions in power electronics to help solve the most challenging problems in electrification and foster rapid adoption of EVs. Exro has developed a new dynamic controller, the smart Coil Driver™, that replaces the standard controller of an electric motor. Switching automatically and seamlessly, Coil Driver™ selects the appropriate torque profile to optimize the current torque and speed demand. Unlike standard electric motor inverters, Coil Driver™ achieves 100% utilization of DC link voltage in both its series and parallel modes. This significantly extends the capabilities of the electric motor, leading to overall motor torque output improvements and enhanced power across the speed spectrum.

With Exro’s Coil Driver™ inverter vehicle manufacturers can optimize their e-powertrain designs and unlock the underutilized potential within electric motors. This provides manufacturers with the flexibility to either increase performance or maintain performance and reduce the cost of electric vehicles. Consumers, in turn, can benefit from the added performance, or purchase more affordable vehicles, and in either case find great relief to their range anxiety with the prospect of efficient systems providing extended range for electric vehicles with Exro’s Coil Driver™ inverter inside. The market’s common problems with electric cars are resolved with Exro Technologies. As EV trends indicate, the future is electric, and Exro will help make it so.